What Is The Average Credit Score.

Steering the complexities of credit scores can be daunting, but understanding what constitutes an average credit score is essential in managing your financial health. A score that lands you in the average range in the United States could significantly impact your economic choices and opportunities. Let’s delve into the intricacies of the average credit score and unravel how it can shape your financial journey.

What Is Considered An Average Credit Score In The United States?

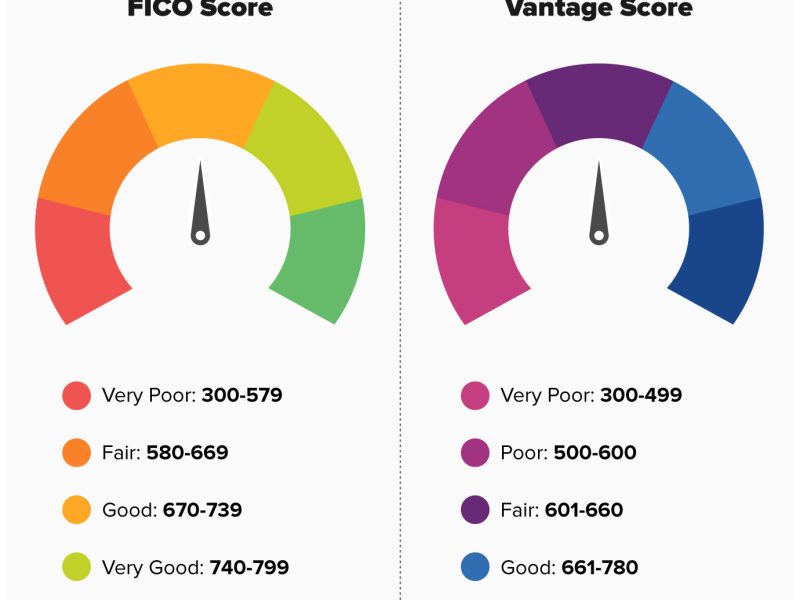

When discussing credit health, the spotlight often shines on the average credit score, commonly found within the 670 to 739 bracket, according to most scoring models. Scores in this segment are akin to a financial thumbs-up, indicating the borrower presents a moderate risk to creditors. The celebrated FICO and VantageScore systems distinguish scores below 670 as less favorable, while those loftier than 739 are considered exemplary.

Let’s flesh out this topic:

This “good” credit territory serves as a gateway to more appealing interest rates and augments the likelihood of loan and credit approvals.

Demographic distinctions like age, earnings, and geographical locales can sway the average, alongside individual credit conduct.

Entering this average credit score band isn’t just a rite of passage; it’s a critical determinant in the fiscal offers that come your way.

To illustrate, consider the following points:

- Creditors may extend lower interest rates to individuals straddling the average score line.

- An average score can mean the difference between a “yes” and a “no” on your next credit application.

- A peek into different demographics showcases the variability of this so-called average, underscoring its dependency on a mosaic of economic behaviors.

An average credit score is more than just a number – it’s a barometer of credit health that bears considerable weight in your financial ventures.

How Is An Average Credit Score Determined, And Why Does It Matter?

At the heart of your credit score lies a complex calculation, a blend of credit history ingredients such as payment timeliness, how much of your credit you’re utilizing, the longevity of your credit accounts, the diversity of your credit types, and the frequency of new credit investigations.

Scoring models, like the enigmatic FICO and VantageScore, apply their secretive algorithms to translate these factors into your personalized credit score. The mean credit score is a compass for lenders, steering their discernment on risk as they approve loans and credit lines.

Ascending into higher average score realms often means more agreeable credit terms, propelling financial opportunities forward.

Understanding where you stand relative to the average can fuel adept financial planning and unlock superior credit conveniences.

Here are nuggets of truth:

- A higher average score could translate to reduced lifetime borrowing costs.

- Conversely, stragglers in the score spectrum might contend with stringent lending stipulations or outright rejections.

- Stay apprised of the average credit score currents and how they fluctuate over time – it’s an ace up your sleeve for fiscal proficiency.

In sum, the gravity your credit score holds in the financial universe is undeniable – it’s the cornerstone of your credit story, shaping the trajectory of your financial future.

Can Having An Average Credit Score Impact My Ability To Get A Loan Or Credit Card?

Stationed at the average credit score, the mark may bring mixed blessings in the financial domain. Lenders often set their sights on loftier scorers, bestowing them with choicer rates – a truth that underscores the advantages of transcending the mean.

Average scorers may confront heightened rates, inflating the cost of borrowing.

Credit capacities on cards might be constricted, and reward offerings trimmed for those latching onto the average.

On occasion, lenders might request further proof of fiscal solidity or an ally in the form of a co-signer to seal the deal.

Peruse these scenarios:

Shopping for a credit card could yield fewer frills if your score exceeds the average.

Navigating the loan landscape might involve braving higher-priced borrowing waters.

Yet, the light at the tunnel’s end remains bright; average credit is not a credit death knell – it’s an impetus to elevate your score for more luscious financial fruits.

Brandishing an average credit score is not a financial cul-de-sac but a clarion call to bolster one’s credit stature for more opulent opportunities.

What Steps Can I Take To Improve My Credit Score If It’s Around The Average?

Should your credit score be flirting with the average, fret not, for the road to score enhancement is well-trodden and ripe with opportunity. Here’s a beacon to guide you out of the average abyss and into credit score ascendancy:

Dig into your credit report’s fabric: Scour your annual free reports for errors to rectify and polish your credit reflection.

Punctuality in payments is paramount; this stalwart behavior cements a robust payment history – a linchpin in credit scoring algorithms.

Envision this path forward:

- Are debts looming large? Aggressively pay down those balances to shrink your credit utilization, a pivotal score influencer.

- Halt the new credit carousel of applications; each inquiry nuances your score downward, and an overabundance of newfangled accounts can mar your score.

- Credit types in your portfolio: Nurture them responsibly. A rich blend of credit experiences, installment loans, or revolving accounts can buoy your score.

To wrap up, embracing these credit fortification strategies can illuminate your path from an average credit existence to a score celebrated in financial echelons.

Where Can I Check My Credit Score To See If It Falls Within The Average Range?

In today’s digital finance era, many platforms parade your credit score. From annual reports from credit czars to banking perks offering score glimpses, staying abreast of your credit stance is simpler than ever.

A roadmap for discovery:

At your behest are sites like AnnualCreditReport.com, which dole out your score yearly from three credit bureau giants.

Indulge in the credit score monitoring graciously offered by many card issuers and banking institutions, available via their digital banking realms.

Venture into third-party financial services like Credit Karma or Mint, which herald credit score refreshes, complete with actionable insights.

Consolidate your knowledge:

Leverage complimentary services from your bank or credit card provider to stay informed on your score.

Credit education can be augmented with help from non-profit counselors, bridging the gap between your current score and how to nurture it.

Vilify scams and extra costs by partnering with only the most esteemed and safeguarded score providers.

Conclusively, the path to score enlightenment is rife with trustworthy avenues, and armed with them, stepping into the average credit score circle for a candid reflection becomes a steadfast reality.

Average Credit Score By Age 25

The dance with credit scores begins anew as young adults step over the threshold of their 25th year. This is a prime stage where early financial patterns sow the seeds for future credit portraits, painting a picture that can swing between fairness and aspiration.

Tracing the financial outlines:

Credit experiences begin to crystallize at this juncture, planting average scores in the mid-to-lower 600s—a reflection of burgeoning credit histories.

The crosswinds of youthful credit card use, student loan commitments, and the practice of punctual repayments shape this tender average.

Visible contours begin to emerge:

A tango with student loans may haul down the credit utilization barometer, gently nudging credit scores in response.

Credit fates can be forged positively by shunning unnecessary credit excursions and ensuring timely bill settlements.

Summarily, those standing at the age 25 gateway hold the keys to sculpting their credit scores, etching out pathways to more substantial financial prospects.

Average Credit Score By Age 30

As the calendar pages turn towards an individual’s thirtieth year, credit scores tend to receive a respectable polish, settling snugly into a wholesome “good” category. This span is marked by financial evolution, the maturation of credit sensibilities, and the nurturing of scores that resonate with fiscal responsibility.

Let’s chart their course:

An increment in score averages reflects an elevated ability to juggle nuanced financial scenarios—credit cards, loans, and on-time payments all work harmoniously to foster accolade-worthy scores.

A diverse financial tapestry, resplendent with mortgages or auto loans, embellishes the credit mix, and the positive ripple effect on scores is evident.

Pivotal pivots in the credit journey:

The clumsy missteps of the twenties, speckled with delinquencies and hard queries, recede in the rearview, easing the average score’s progress.

Financial steadiness comes to the fore, outlining a tapestry of credit scores that herald an age of financial self-awareness.

In essence, the milestone of thirty heralds a tranquil maturation of fiscal habits—a consolidation of past lessons propelling future credit score triumphs.

Average Credit Score By Age 40

Credit scores often bask in the glow of increment by the fourth-decade milestone, indicative of financial sagacity that accrues over the years. This is an epoch highlighted by active engagement with diverse credit mediums—home loans, automobiles, plastic money—all conspiring, when prudently managed, to hoist credit scores.

Stationed in their forties, many exhibit credit scores that attest to seasoned financial rituals, soaring into the laudable upper 600s or even brushing the 700s.

Credit scores in this echelon echo robust income streams, the aggregation of assets, and a concerted push towards debt diminishment and credit refinement.

Recognizing the indicators:

Forty-something often set their sights on creating the 720-credit score apex, a preparatory move for pinnacle fiscal aspirations—homes, education, and investment gambits.

The underpinnings here are strong—a score reflecting judicious credit maneuvers optimized for commanding financial maneuvers ahead.

In recapitulation, age forty is an enabler of financial fortitude, as evinced by credit scores, laying a foundation for bold fiscal adventures tailored for the years to stretch.

Average Credit Score By Age 50

Trajectories of credit scores are often upward inclining, mating with advancing age. For the golden jubilee age, these scores often manifest the pinnacle of a credit journey as years of borrowing and spending wisdom come to fruition.

Sketching the credit contour:

An individual’s fiftieth year is often a summit in the credit scape, with scores drawing from a varied credit history woven over time through diverse borrowing mediums.

The score range prevalent amongst this contingent imprints fiscal maturity and a lineage of debt-handling finesse.

The score-scape panorama paints:

Enlightened by life’s fiscally convoluted courses, the 50s brigade relishes the fruits of elevated scores – reflecting better loan rates and generous credit offers.

These are the score barons – the financial connoisseurs – to whom credit is no stranger but a well-tamed ally, fostering a formidable position in the lending arena.

Thus, the age of fifty is synonymous with credit distinction – a testament to years of prudent financial navigation, ensuring a credit score that resonates with fiscal prosperity.

Your Score in the Financial Symphony: Moving Beyond Average

In the grand orchestra of credit, the average credit score strikes neither the highest nor the lowest note but plays an integral role in the financial melody of your life. Whether you’re a neophyte in the realm of credit or well-versed in its nuances, understanding the ins and outs of this pivotal figure can be an empowering symphony – one that enables you to conduct your fiscal affairs with grace and purpose.

Remember, the average credit score is but a snapshot of your broader financial opus. It embraces your past but can be shaped by your present actions—a dynamic and responsive ally on your journey toward economic crescendos.

Knowing where you stand empowers you to compose the next movements in your credit score masterpiece, with each financial decision a note that brings harmony to your long-term financial stability and prosperity.