How To Interpret Credit Score Ranges:

Steering in the world of financial stability and credit can be puzzling. Among the various metrics and measurements, your credit score is a crucial piece of the puzzle—acting as a financial fingerprint that lenders use to assess risk and make lending decisions. Understanding your credit score and its implications is an empowering step towards financial wellness.

In this blog post, we decode the credit score ranges, providing you with the decoder ring you need to interpret what those numbers truly mean for your fiscal future.

What Is A Credit Score And How Is It Determined?

Understanding what a credit score is and the components that shape it is fundamental. A credit score represents your creditworthiness to potential lenders. It is the condensed story of your financial behaviour, distilled into a number between 300 and 850.

This score is molded by various credit-related activities:

- Payment history: A chronicle of how consistently you meet debt obligations.

- Credit Utilization: The ratio of your outstanding debt to available credit.

- Credit History Length: The time span of your activity with credit accounts.

- Credit Mix: Diversity in types of credit, like installment loans and credit cards.

- New Credit Inquiries: The frequency of your applications for new credit.

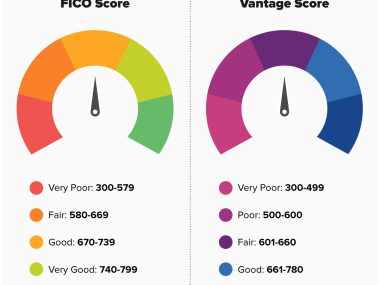

Major credit scoring models like FICO and VantageScore play the role of biographers, analysing these aspects through algorithms to determine your score. Each factor is weighted differently within their models, resulting in those little fluctuations we often see across different scoring platforms.

- FICO is known for its model, that emphasises payment history and credit utilization.

- VantageScore may give more weight to the age and type of credit, plus recent credit behaviour.

Beyond the matrix of numbers, a credit score impacts life’s significant moments: getting a loan, buying a car, even renting an apartment. It can influence interest rates, credit card limits, and it could peek into certain employment screening processes.

Examples and Tips:

- Review your credit reports regularly to check for errors or discrepancies.

- Maintain lower credit card balances to manage credit utilization effectively.

- Aim for timely bill payments to foster a positive payment history.

- Diversify your credit accounts over time to enhance your credit mix.

Understanding your credit score is akin to having a map in an unknown city—it guides you through financial opportunities and risks. By delving deep into the determinants of a credit score, you’re taking the driver’s seat on the journey to credit excellence.

Can You Explain The Different Credit Score Ranges And What They Mean?

Navigating through the credit score terrain requires knowing the landmarks—the credit score ranges. These numerical categories forecast the reception you’ll get in the world of lending:

300–579: Poor—financial distress signals, suggesting high-risk to lenders.

580-669: Fair—WWading into subprime territory; not hopeless but expensive.

670–739: Good—stable in sight, a comfortable zone with moderate borrowing terms.

740-850: Excellent—the financial promised land, unlocking the best loan conditions.

Recognising your score’s impact on potential financial ventures is crucial. With a poor score, securing credit can be an uphill battle, dotted with high rates and tight purse strings from lenders.

A fair score elicits caution, while a good score starts to open doors. Those with excellent credit are esteemed borrowers, likely to receive the most appealing offers.

Practical Insights:

- A score below 580 might necessitate security deposits or co-signers.

- Achieving a score over 669 often equates to better credit card rewards and loan terms.

- Breaching the 740 mark? Expect competitive interest rates and generous credit lines.

Considering these implications, it’s ever more apparent why one’s position within this spectrum is a cornerstone of financial strategy. Anchoring oneself in these credit score territories imparts not just knowledge but negotiation power in the credit landscape.

How Does My Credit Score Affect My Ability To Get A Loan Or Credit Card?

The significance of a credit score comes sharply into focus when seeking to borrow. A higher credit score is the golden ticket to lender confidence—unlocking loans and credit cards under enviable conditions:

- Preferential interest rates: The beckoning call of a high score.

- Increased borrowing limits: A u-turn from financial constraints to opportunities.

- Loan selection: A spectrum of borrowing options tailors to your fiscal portrait.

In contrast, a low score might culminate in steeper rates and limited access to credit products. Credit card issuers, in the glow of impressive scores, may shower you with rewards and minimal fees. The intersection of a good credit score and financial opportunities is not ignorable—it’s a currency in itself.

Key Takeaways:

- Those with scores in the upper echelons often enjoy 0% introductory offers.

- Subprime scores may lead to higher deposits and annual fees.

- Flexibility and choice are the hallmarks of excellent credit in the marketplace.

Your credit score underpins every application for credit, acting as a beacon for potential lending paths. Ascending the score ladder isn’t just about pride—it’s about access to better financing and saving money over the lifespan of your loans and credit endeavors.

What Can I Do To Improve My Credit Score If It’s Lower Than I’d Like?

Improving a credit score might seem a daunting quest, but it’s a path well-trodden with clear trail marks. Increasing your credit score hinges on several actionable steps:

- Ensuring the accuracy of your credit reports dismantles any false barriers to a better score.

- Consistency in bill payments lays down a steady track record of reliability.

- Diminishing credit card balances against their limits enhances your credit utilization stature.

Avoid rapid-fire credit account openings, which can unsettle the average age of your credit history, and contemplate a judicious blend of credit types.

Concrete Steps:

- Periodically monitor your credit reports for updates and improvements.

- Use alerts or automatic payments to fortify your payment timeline.

- Strategize credit use: Lower than 30% utilization bodes well for score ascension.

Climbing to the next credit score summit requires time, patience, and a strategy—a testament to the art of diligent financial management. The ripples from these steps can gradually elevate your score, unveiling new financial horizons.

How Often Should I Check My Credit Score, And Where Can I Find It?

A regular review of your credit score is the compass of sound financial direction. Checking your credit score should skirt the annual mark or embrace a more frequent tempo if changes in financial standings are apparent.

Access your credit score effortlessly through:

- Complimentary score services are offered by credit card companies or banks.

- Kenned credit report websites or reliable credit monitoring services.

- Platforms provide FICO or VantageScore, insights to keep tabs on lender perspectives.

Each check is akin to a financial pulse, verifying the health of your credit status and ensuring you’re aligned with your financial strategies.

Where to Look:

- Leverage bank or credit card provided scores.

- Explore free credit websites or invest in a credit monitoring service.

- AnnualCreditReport.com: Your statutory source for a free annual credit report.

Staying on top of your credit score is not an arcane ritual; it’s an informed habit that sharpens your financial acumen. In doing so, you arm yourself with data-driven knowledge to make weighty financial decisions with confidence and clarity.

Illuminating Your Credit Journey

Interpreting credit score ranges lifts the veil on your financial blueprint, transforming abstract figures into actionable intelligence. This elucidation grants you control—turning the numbers on their heads to work for you, paving the way for advantageous financial manoeuvres.,.

Keep in mind, credit scores are a financial tool, and mastering how they function is the key to unlocking opportunities that resonate with your economic aspirations.

In the unfolding saga of credit, remember that every action contributes to this dynamic scorecard—cautionary tales and triumphs alike. Examine these benchmarks often, strategize with purpose, and wield your credit score as a testimonial to your financial sagacity. When the numbers align, the narrative is yours to write.